Faisalabad Cybercrime Bust: 149 Arrested in Ponzi Scheme Raid

- Zain Ul Abideen

- Reading Time 7

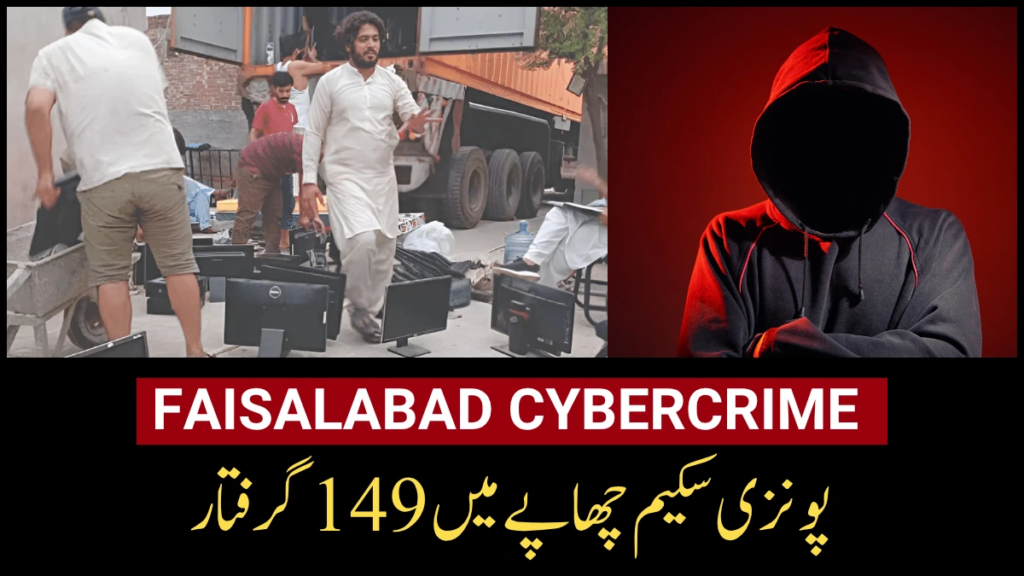

Pakistan’s National Cybercrime Investigation Agency (NCCIA) conducted a major raid in Faisalabad, uncovering a massive online scam operation. The raid targeted an illegal call center in Chak 54 RB, Sirohli, reportedly owned by Malik Tehseen Awan, a former chairman of the Faisalabad Electric Supply Company (FESCO) Board of Directors. Authorities arrested 149 suspects, including 78 Pakistani nationals and 73 foreigners, for running Ponzi schemes that defrauded people of millions of rupees through fake investment opportunities.

What Happened During the Faisalabad Raid?

The NCCIA, in collaboration with local law enforcement, raided a factory-turned-call-center in Shangla Hill, Shahkot Road, Faisalabad. The operation was based on a tip-off about a large-scale cybercrime network. The suspects were allegedly deceiving people with promises of high returns through fraudulent investment schemes. During the raid, authorities seized numerous laptops and gadgets, requiring a trailer to transport the evidence. The facility was allegedly managed by Malik Tehseen Awan, who escaped during the operation and is now a prime suspect in seven First Information Reports (FIRs) filed by the NCCIA.

Court Proceedings and Remands

On July 9, 2025, the 149 suspects were presented before Faisalabad Special Court Judge Malik Muhammad Ashfaq under tight security. The court approved a five-day physical remand for 87 suspects, including 18 women, to allow the NCCIA to interrogate them further about their involvement in the online scams. The remaining 62 suspects were sent to district jail on a 14-day judicial remand. The charges against the group include fraud, forgery, and illegal investment operations under sections 13, 14, and 16 of the Prevention of Electronic Crimes Act (PECA) and sections 109, 419, and 420 of the Pakistan Penal Code (PPC).

Who Were the Suspects?

The arrested individuals include a diverse group of 78 Pakistani nationals and 73 foreigners from countries such as China, Nigeria, the Philippines, Sri Lanka, Bangladesh, Zimbabwe, and Myanmar. Among them were 131 men and 18 women, all allegedly involved in running the Ponzi scheme network. The operation marks the largest single crackdown on cybercrime suspects in Pakistan’s history.

Category | Details |

Total Suspects | 149 (78 Pakistani, 73 Foreigners) |

Foreign Nationalities | China (48), Nigeria (8), Philippines (4), Sri Lanka (1), Bangladesh (7), Zimbabwe (1), Myanmar (2) |

Gender Breakdown | 131 Men, 18 Women |

Charges | Fraud, Forgery, Illegal Investment Operations (7 FIRs: 141–147) |

Prime Suspect | Malik Tehseen Awan (currently at large) |

Court Action | 87 on 5-day physical remand, 62 on 14-day judicial remand |

Malik Tehseen Awan: The Prime Suspect

Malik Tehseen Awan, the alleged mastermind behind the scam, is a former FESCO chairman and a prominent figure in Faisalabad. Authorities claim he lured victims into fake online work and investment schemes, defrauding them of millions. After escaping during the raid, Awan has been named in seven FIRs, and the NCCIA has requested his inclusion on the Provisional National Identification List (PNIL) to prevent him from fleeing Pakistan. Raids are ongoing to apprehend him, and the NCCIA has urged citizens to report suspicious online activities.

This bust highlights the growing issue of cybercrime in Pakistan, particularly Ponzi schemes that exploit digital platforms to deceive the public. The NCCIA has intensified its efforts to crack down on illegal call centers, emphasizing the need for public awareness about fraudulent investment offers. The agency advises citizens to be cautious of “too-good-to-be-true” deals and to verify investment opportunities before committing funds.

Other Recent Cybercrime Arrests in Pakistan

In a separate operation on July 9, 2025, the Federal Investigation Agency (FIA) arrested Farrukh Nazir Nakodria in Mianchannu, Faisalabad, for defrauding people by promising fake job opportunities in Saudi Arabia. The suspect had fled to Saudi Arabia after extorting millions but was apprehended upon his return. These incidents underscore Pakistan’s ongoing battle against cybercrimes and financial fraud.

Public Advisory and Staying Safe Online

The NCCIA has issued a public advisory urging people to avoid falling for fake investment schemes and to report suspicious activities to authorities. As digital transactions increase, so do sophisticated scams, making vigilance crucial. The agency is committed to cracking down on cybercrime networks nationwide to protect citizens from financial loss.

فیصل آباد: ن لیگی رہنما و سابق چیئرمین فیسکو بورڈ ملک تحسین اعوان کے ڈیرے پر چھاپہ، انٹرنیشنل سائبر فراڈ نیٹ ورک کے 71 ملکی و غیر ملکی ہیکرز گرفتار، مقامی عدالت میں پیش کردیا گیا۔

— Faisalabad TV (@FSDTv41) July 9, 2025

1/2#cybercrime #Faisalabad #FaisalabadTV #FsdTV41 #Police@fsdpolice @rpo_faisalabad pic.twitter.com/5Tsn3oHC08

Pakistan's NCCIA arrests 149, including 48 Chinese nationals, in Faisalabad for alleged bank hacking & cybercrimes. Major crackdown on syndicate operating from a factory in Chak 54-RB. pic.twitter.com/Et8CPumxqs

— Ali K.Chishti Official (@thewirepak) July 9, 2025

فیصل آباد: غیر ملکی خواتین آن لائن فراڈ میں گرفتار، BISP و جعلی انعامی سکیموں کا جھانسہ دے کر شہریوں سے رقم بٹورتی تھیں۔ سائبر کرائم و حساس اداروں کی کارروائی میں موبائل، سمز و دیگر شواہد بھی برآمد۔ خواتین کو عدالت میں پیش کر دیا گیا#Faisalabad #OnlineFraud #CyberCrime #BISPScam pic.twitter.com/MtmUaTPZgD

— Faisalabad TV (@FSDTv41) July 9, 2025

A Ponzi scheme is a fraudulent investment scam where returns are paid to earlier investors using funds from newer investors, creating the illusion of profit. The Faisalabad call center allegedly used such schemes to deceive people with fake high-return investment offers.

Malik Tehseen Awan, a former chairman of FESCO, is the prime suspect accused of running the illegal call center in Faisalabad. He allegedly managed the Ponzi scheme network and is currently wanted in seven FIRs.

A total of 149 suspects were arrested, including 78 Pakistani nationals and 73 foreigners from countries like China, Nigeria, and the Philippines.

The NCCIA has added Awan’s name to the Provisional National Identification List (PNIL) to prevent him from leaving Pakistan and is conducting raids to apprehend him.

Verify investment opportunities through trusted sources, avoid offers promising unrealistic returns, and report suspicious activities to the NCCIA or local authorities immediately.

Send Us A Message

Punjab Schools Reopen: New Schedule for August 2025 After Reduced Summer Vacation

Earthquake Today: 5.4 Magnitude Quake Jolts Pakistan, 8.8 Hits Russia

Tsunami Waves Hit Pacific Coasts After Massive Russia Earthquake

Mardan Board Result 2025: Punjab Private Schools Shine, Government Schools Improve