Pakistan Suzuki Motor Company (PSMC) made a stunning recovery in August 2025, recording significant growth across its core hatchbacks—Suzuki Alto, Suzuki Cultus, and Suzuki Swift. After months of sluggish demand, companies capitalized on improved supply chains, stabilized macroeconomic conditions, and easing restrictions.

Suzuki Alto – Pakistan’s Best-Seller

- Sales (Aug 2025): 4,193 units

- Year-on-Year (YoY) Growth: +107% (2,023 units in Aug 2024)

- Month-on-Month (MoM) Growth: +80% (2,327 units in Jul 2025)

- Sharp Increase: 179% rise in June sales (Pakwheels)

The Alto continues to dominate the entry-level segment, known as the top-selling small hatchback, thanks to its affordability and fuel efficiency.

Suzuki Cultus – The Quiet Performer

- Sales (Aug 2025): 497 units

- Year-on-Year (YoY) Growth: +279% (131 units in Aug 2024)

- Month-on-Month (MoM) Growth: +108% (239 units in Jul 2025)

The Cultus is gaining traction among buyers seeking an upgrade from the Alto but at a lower cost than sedans.

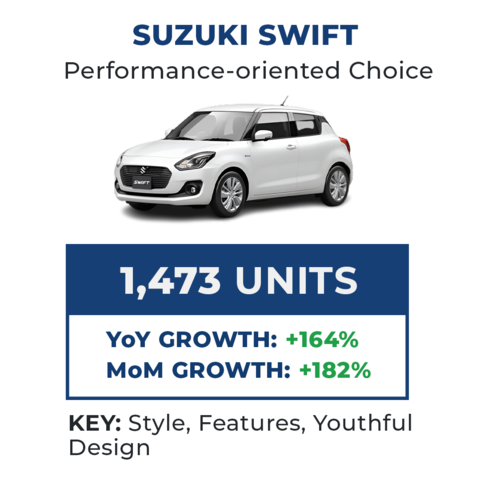

Suzuki Swift – The Youthful Choice

- Sales (Aug 2025): 1,473 units

- Year-on-Year (YoY) Growth: +164% (559 units in Aug 2024)

- Month-on-Month (MoM) Growth: +182% (522 units in Jul 2025)

The Swift appeals to young buyers with its sporty design, modern features, and performance.

Also Read:

Yamaha Launches “Purani Do, Nai Lo” Exchange Offer in Pakistan

Overall PSMC Sales

- Total Sales (Aug 2025): 7,154 units

- YoY Growth: +96%

- MoM Growth: +94%

- Massive Increase: 139% overall sales rise in June (Pakwheels)

Market Recovery Drivers

- Eased Import Restrictions: Suzuki and other automakers were able to clear backlogged orders.

- Exchange Rate Stability: Helped reduce uncertainty in pricing.

- Improved Financing: Auto loans have slowly resumed, albeit with stricter conditions.

- Pent-Up Demand: Consumers returned to dealerships after months of suppressed activity.

In FY25, Pakistan’s passenger car sales rose 43% YoY, reaching 148,023 units compared to 103,829 units in FY24. June 2025 marked a three-year high with 21,773 units sold. Data reported by Pakistan Automotive Manufacturers Association (PAMA) and Pakwheels confirmed this recovery.

Challenges Ahead

Used Car Liberalization

- The government is increasing the import age limit for used cars to 5 years, alongside tariff reductions.

- Projections suggest used imports may jump from 30,000 to 70,000–80,000 units annually, reducing local car prices by up to PKR 1 million and pressuring sales.

Structural Concerns

- Under the National Tariff Policy 2025–30, gradual duty removal threatens local manufacturers like Suzuki.

- Analysts warn of potential revenue losses of Rs 878 billion and risks to over 2 million jobs.

Tax & Cost Pressures

- New green taxes (1–3%), GST hikes for small cars (12.5% → 18%), and inconsistent policies complicate industry planning for Suzuki and others.

Growth Metrics Table

| Vehicle | Aug 2025 Units | YoY Growth | MoM Growth |

| Suzuki Alto | 4,193 | +107% | +80% |

| Suzuki Cultus | 497 | +279% | +108% |

| Suzuki Swift | 1,473 | +164% | +182% |

| Suzuki PSMC Total | 7,154 | +96% | +94% |

Other models Suzuki like Wagon R, Every, and Ravi are also part of PSMC’s portfolio, though their growth was less significant compared to Alto, Cultus, and Swift.

Future Outlook

- Economy: Pakistan’s GDP expected to grow around 2.6–2.7% in FY25.

- EV Growth: BYD Pakistan expects EV and plug-in hybrid sales to grow 3–4× by 2026, targeting 30–35% market share. Local EV assembly is set to begin mid-2026.

- Policy Incentives: Reduced tariffs, tax exemptions, and charging infrastructure are being introduced to support EV adoption, requiring to adjust strategies.

Join The Discussion